Top 4 Findings From Gartner's Market Guide for Software Asset Management Tools

With enterprise software spending projected to increase through the remainder of the year, more and more organizations are exploring software asset management (SAM) tools to see how they can reduce the amount of time spent managing complex licenses, take advantage of automation or identify wasted spend.

Gartner’s latest Market Guide for Software Asset Management Tools1 offers a detailed look at SAM tools currently on the market, with the aim of helping IT leaders select the right tools to support their strategy.

Gartner defines these tools as “products that help optimize software and SaaS spend while supporting the automation of tasks required to maintain compliance with software license and SaaS subscription use rights.” The market, however, is changing. The variety and complexity of technology that needs to be managed is increasing, there are more SAM tools than ever before and automating SAM has become increasingly challenging due to licensing complexity.

Read on to discover how the market is changing, what you should look for in a SAM tool and what we believe, are four of the top findings from the guide.

The DINRGOS Framework

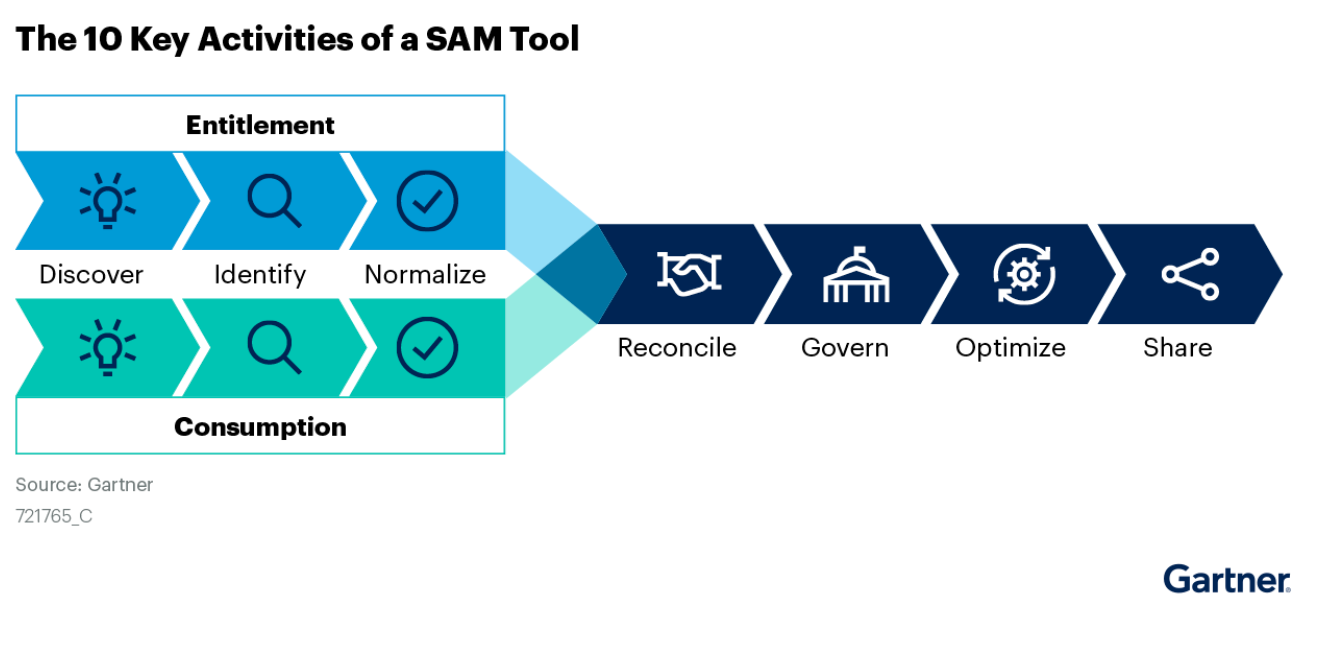

The Gartner Market Guide identifies 10 key activities that a SAM tool should offer in 2021. The DINRGOS framework, illustrated and explained below, can be used as a baseline to plan improvements, understand current SAM capabilities and compare different software asset management tools.

1. Platform discovery – Interrogate to find physical, virtual and cloud platforms

2. Entitlement discovery – Integrate with vendor portals, sourcing and vendor management systems to find software contract, purchase and procurement records

3. Identify consumption – Extract a list of all software and software consumption

4. Identify entitlements – Decode software contracts, purchases and procurement

5. Normalize consumption data – Resolve duplicated or conflicting records and data collected by multiple tools

6. Normalize entitlement data – Produce a single, accurate, organized and categorized inventory of entitlements

7. Reconcile – Harmonize contract, purchase and entitlement information with normalized inventory data to produce effective license position

8. Govern – Allocate licenses, identify remediation actions for noncompliance and over-licensing, and automate workflows

9. Optimize – Balancing software spending with usage

10. Share – Provide information for use throughout the IT ecosystem

Managing emerging technology

One of the important trends in SAM that is captured in the market guide is the increasing variety and complexity of technology that is expected to be covered by SAM managers. Much of this is driven by an increase in cloud spending.

- In 2021, SaaS spend is expected to reach $147.7B, a YoY increase of 19.9%

- Also in 2021, IaaS spend is expected to increase YoY by 42.3%, to $92.1B

Despite these increases, the responsibility for managing these technologies varies across organizations. Only 41% of SAM teams own SaaS application management and just 34% cover public cloud spend. Moving forward, organizations will have to determine whether their current processes for tracking and managing this cloud spending are adequate.

Automating SAM

The increase in the variety of technologies that some expect SAM teams to manage compounds a long-standing challenge for SAM and IT teams: manual processes for importing entitlements. When vendors primarily sold based on “one license, one machine,” this level of manual effort was manageable. However, new technology has introduced an exploding variety of license and entitlement models, including:

- Bundles and subscription levels

- Multiple metrics

- Subcapacity calculations

- Hybrid use/BYOL models

According to Gartner, “The complexity of licensing doesn’t stop with the diverse licensing types and infrastructure; in fact, it’s just the beginning. Organizations are increasingly reliant on software, which requires them to add more software publishers and applications. With each of these publishers and products, management can become exponentially more challenging …”

Integrating SAM data into the wider IT ecosystem

Leading SAM teams have long recognized that they possess the most complete, most current source of software, hardware and usage information across the enterprise. They also acknowledge that many other enterprise teams can use this data, including:

- Sourcing/Procurement – Detailed usage information can help drive better renewal contracts and save money

- Finance/IT Finance – This data can help create a holistic picture of spend across the organization

- Enterprise Architecture – Software and hardware details help drive efficient refresh rates

Though a SAM team may have the best insights into data and asset usage in an organization, they are not the only teams to benefit from them. Groups across an enterprise can make better, more informed decisions and realize positive outcomes from the data.

Lack of resourcing holds SAM back

Even organizations that follow best practices of defining areas of management, creating a SAM charter and investing in leading technology are sometimes hobbled by inadequate SAM staffing. While the automation mentioned earlier is key, it doesn’t eliminate the need for skilled personal to understand complex licensing, define and implement governance and communicate with other IT stakeholders.

As noted by Gartner, lack of resourcing can be addressed with a SAM Managed Services Program (MSP), but it still doesn’t bring resourcing need to zero: “While SAM MSPs offer a solution to the scarce supply of skills, enterprises must see the MSP as an extension of their staff, ensuring they still hold the overall accountability for their SAM discipline. Therefore, the internal organization must have an overall SAM process owner, accountable for governing the discipline while working with the SAM MSP on the daily operational tasks and their internal network of supporters.”

We’ll also provide additional analysis and perspectives on the blog as we dig even deeper into these findings over the next couple months.

1 Gartner, “Market Guide for Software Asset Management Tools” by Ryan Stefani. September 20, 2021.

2 This graphic was published by Gartner, Inc. as part of a larger research document and should be evaluated in the context of the entire document. The Gartner document is available upon request from Snow. Gartner Disclosure:

Gartner does not endorse any vendor, product or service depicted in its research publications, and does not advise technology users to select only those vendors with the highest ratings or other designation. Gartner research publications consist of the opinions of Gartner’s research organization and should not be construed as statements of fact. Gartner disclaims all warranties, expressed or implied, with respect to this research, including any warranties of merchantability or fitness for a particular purpose.