Why Application Rationalization Is Key To Accelerating M&A Synergies

For a merger and acquisition (M&A), it is crucial for practitioners to capture operational and financial synergies. To accurately assess synergies, IT leaders need to have a good understanding of the application stack (contracts, vendors, applications and infrastructure) used in each functional area of the business and compare these stacks to the acquired organization.

Today, application stacks are comprised of hybrid applications and infrastructure. Many organizations lack visibility to cloud environments added in recent years, and it has become increasingly challenging for IT leaders to see overlaps in technology and identify opportunities for application rationalization during the M&A process.

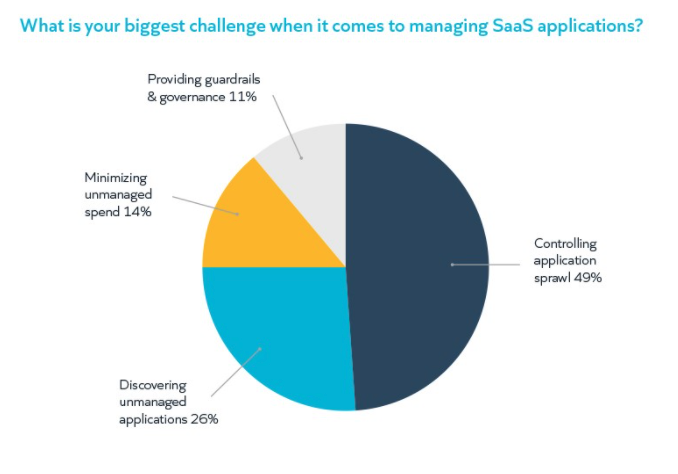

Businesses experiencing multiple recent acquisitions and mergers have an even greater challenge with SaaS sprawl, resulting in redundancies, risk and waste. According to a survey, 73% of IT leaders have seen an increase in the use of SaaS applications in the last year. And, many of those leaders have reported a host of other challenges when it comes to managing SaaS.

So, what’s the best way to face this integration process?

Due Diligence Pre-Acquisition

One of the most time-consuming tasks of buyer due diligence is understanding risk related to material contracts, including hardware and software IT asset contracts.

The purpose of due diligence is to understand risk of buying the target and what mitigating activities should be prioritized post-deal. Often, M&A triggers audit activities, so it’s important to understand license compliance and contract status to create a mitigation plan that can be acted upon quickly.

To prepare, you should try to understand:

- What are the most expensive contracts, and will the acquiring company have rights to the software after the deal goes through?

- Are there non-cancelable clauses of these contracts? How many licenses are owned, how many are allocated and in use by the target organization?

- If the vendor is in use by the buyer, what does the combined license position look like?

- What are the key upcoming renewal dates you’ll need to be prepared for once the ink has dried?

- What are the significant renewals that have taken place over the last year and the details of these contracts? Once the deal is closed, you might lose access to employees with knowledge of these key contracts so it is important to document these details during the due diligence process.

If the target organization has a software asset management practice and related tools in place, it should make due diligence a little easier. Due to the maturity of software asset management practices managing modern cloud environments, you may have visibility gaps to overcome.

Mitigating Post Deal Risk

Once the ink is dried, you can get to work on assessing license compliance status and optimization opportunities by discovering software in use throughout the organization, compared to licenses and subscriptions owned.

Another area of risk to assess is whether you have applications running that are out of maintenance. Reporting on application version details will also help your team understand how important it is to standardize on one or few versions to reduce impacts related to patch management.

Even though you’ve identified software contracts and terms, there are likely SaaS applications in use that you’re not aware of. These applications can be free or licensed. Applications that have not been vetted by IT can put your organization at risk for license compliance, and more importantly at risk of compliance failures and data leaks. To reduce risk, but avoid impacting productivity, you should consider implementing guardrails for your organization.

Identifying Post Deal Synergies

Once your risk posture is under control, and you’ve identified all the applications in use in the combined organization, you can get to work on identifying redundant applications in use. This activity can save not only software and maintenance costs, but also IT operations costs for integrating applications and responding to application performance issues.

Looking at application usage through the lens of the application category will also help your team get consistency on how applications are used in the combined company. For example, pre-deal, perhaps both Teams and Zoom were in use and your team decided to standardize on Teams to drive down cost. Monitoring usage of both applications will help IT determine how quickly the acquired organization has moved to the new standard and what additional education is required.

Before going down the path of M&A, it is critical to get your own house in order from a software asset management perspective so that your organization can move quickly to realize efficiencies from the combined organization.